Unlock the VA Home Loan Advantage: Preapproval Made Easy

The VA home loan preapproval process might seem hard at first. But, with the right help, it can be easy and quick. To start, you need to know the steps and what’s needed to qualify for a VA home loan. Understanding these steps and requirements is key to a smooth home buying journey.

The VA home loan preapproval process is made to make buying a home easier. By following the right steps and meeting the requirements, you can have a smooth experience. Knowing how to get preapproved for a VA home loan is important for a successful home buying journey.

Key Takeaways

- Understanding the VA home loan preapproval process is essential for a smooth home buying journey

- Knowing the steps to qualify for a VA home loan can help you make informed decisions

- VA loan preapproval requirements must be met to ensure a successful preapproval process

- Learning how to get preapproved for a VA home loan can save you time and effort

- The VA home loan preapproval process is a crucial step in becoming a homeowner

- By following the VA home loan preapproval process, you can ensure a successful home buying journey

Understanding VA Home Loan Preapproval Benefits

VA loan preapproval offers many benefits to military service members and veterans. It helps them know how much they can afford and understand their budget. This makes them stronger in the market when making an offer.

Prequalification and preapproval differ in how they verify information. Prequalification gives an estimate, while preapproval checks credit and income more thoroughly. Knowing this difference is key for homebuyers, as it affects their loan chances.

Exclusive Military Service Member Advantages

Military service members and veterans get special benefits with VA loan preapproval. These include lower interest rates, no down payment, and easier credit score requirements. To get these benefits, they need to follow steps to prequalify, which involves sharing financial and credit info with a lender.

Why Preapproval Strengthens Your Home Buying Position

VA loan preapproval makes homebuyers stronger in the market. With a preapproval letter, they can offer homes with confidence, knowing they’re approved for a certain amount. This is very helpful in competitive markets, where sellers prefer preapproved buyers.

Understanding Preapproval vs. Prequalification

Preapproval and prequalification both show how much you can afford, but they differ. Prequalification is less formal, while preapproval checks credit and income more deeply. Knowing these differences helps homebuyers make better choices and enjoy preapproval benefits.

| Benefits | Prequalification | Preapproval |

|---|---|---|

| Level of Verification | Estimate | Thorough Review |

| Accuracy | Less Accurate | More Accurate |

| Benefits | Limited | More Comprehensive |

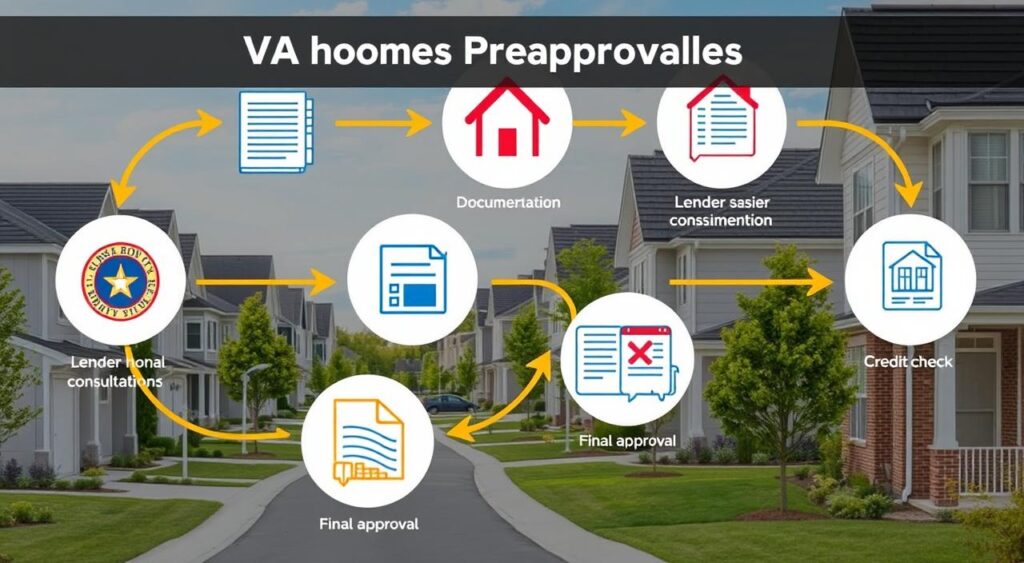

How to Get Preapproved for a VA Home Loan: Essential Steps

To get preapproved for a VA home loan, you need to know the va loan preapproval process. Start by checking your credit score. It’s key to your loan eligibility. You can get a free credit report from the three major credit bureaus and check for errors.

A va loan preapproval checklist helps keep you organized. You’ll need your DD-214, proof of income, and bank statements. Look for the best rates by comparing lenders. Tips for getting preapproved for a va loan include applying early and being ready for extra documents.

Here are some key steps to follow:

- Check your credit score and history

- Gather necessary documents, including your DD-214 and proof of income

- Research and compare rates from different lenders

- Apply for preapproval and be prepared to provide additional documentation if required

By following these steps and understanding the va loan preapproval process, you boost your chances of getting preapproved. Stay organized, be prepared, and ask for help if needed. This will help you reach your home buying goals.

| Step | Description |

|---|---|

| 1 | Check your credit score and history |

| 2 | Gather necessary documents |

| 3 | Research and compare rates from different lenders |

| 4 | Apply for preapproval |

Key Documentation and Requirements for VA Loan Preapproval

To get preapproved for a VA loan, you need to know the requirements and gather all needed documents. The VA checks if you can afford your mortgage payments and have a stable financial situation.

You’ll need military service records, like the DD-214, to prove your service. Also, you must show your income with pay stubs and W-2 forms. A good credit score is important for better interest rates.

Other important documents include proof of employment and bank statements. These show your savings and assets. Knowing what you need and gathering these documents helps you get preapproved smoothly.

Here is a summary of the key documents needed for va loan preapproval:

- Military service records (DD-214)

- Income verification documents (pay stubs, W-2 forms)

- Credit reports and credit scores

- Employment history proof (letter from employer)

- Bank statements and asset documentation

By providing these documents and meeting the VA’s criteria, you show you’re creditworthy. This increases your chances of getting preapproved for a VA loan.

Navigating the VA Loan Preapproval Timeline

Knowing the va loan preapproval timeline is key for a smooth home buying journey. The time it takes for preapproval can change, but a va home loan preapproval guide helps you plan. To get preapproved for a VA home loan, you need to meet certain criteria. This includes providing the right documents and having a good credit score.

The va loan preapproval timeline starts with applying. You’ll send your financial details and documents to the lender. Then, the lender checks your application and orders a property appraisal. This whole process can take a few days to weeks, depending on the application’s complexity and the lender’s speed.

To successfully go through the va loan preapproval timeline, being ready and organized is crucial. Here are some helpful tips:

- Make sure you qualify for va loan eligibility for preapproval before you apply

- Collect all needed documents, like proof of income and credit reports

- Choose a reliable lender with va home loan preapproval experience

By using these tips and knowing the va loan preapproval timeline, you can get preapproved for a VA home loan. This brings you closer to owning your dream home. Always stay informed and updated on the latest va home loan preapproval guide for a successful home buying journey.

Conclusion: Making Your VA Loan Preapproval Journey Successful

By following the steps in this guide, you’re on your way to a successful VA home loan preapproval. It’s important to be proactive and gather all needed documents. Also, work closely with your lender to make the process smooth.

Understanding the VA loan preapproval requirements can help a lot. This way, you can get that preapproval letter and move closer to owning a home. Stay organized, be patient, and let your lender guide you through the steps.

Remember, the VA loan program has special benefits for military service members and veterans. Use these benefits to your advantage. With the right preparation and determination, you can qualify for a VA home loan and find your dream home.

FAQ

What are the steps to get preapproved for a VA home loan?

To get preapproved for a VA home loan, start by gathering your military records and income proof. You’ll also need your credit information. Next, find a VA-approved lender to help you through the preapproval process.

Submit your application and documents, and let them check your credit. After that, you’ll get a preapproval letter.

What are the requirements for VA loan preapproval?

For VA loan preapproval, you need a valid Certificate of Eligibility (COE). You must also meet credit score and income requirements. Provide your military records, income proof, and employment history.

The VA has rules for debt-to-income ratios and property appraisals. These must be followed.

What’s the difference between VA loan preapproval and prequalification?

Preapproval and prequalification are different. Prequalification is a basic check of your finances and credit. Preapproval is a detailed review and verification.

Preapproval shows you’re likely to get a VA loan. It makes you a stronger buyer to sellers.

What are the benefits of getting preapproved for a VA home loan?

Getting preapproved for a VA home loan has many benefits. It gives you stronger negotiating power and lets you act quickly on homes. It also shows sellers you’re serious and qualified.

This can help you stand out in a competitive market.

What documents are needed for VA loan preapproval?

For VA loan preapproval, you’ll need your military records (DD-214) and income proof. This includes pay stubs, W-2 forms, and tax returns. You’ll also need your credit history and score.

Employment history, assets, and debts may also be required.

How long does the VA loan preapproval process take?

The VA loan preapproval process takes about 2-4 weeks. It depends on the lender, your financial situation, and the VA’s processing time. Work closely with your lender and provide all documents quickly for a smooth process.